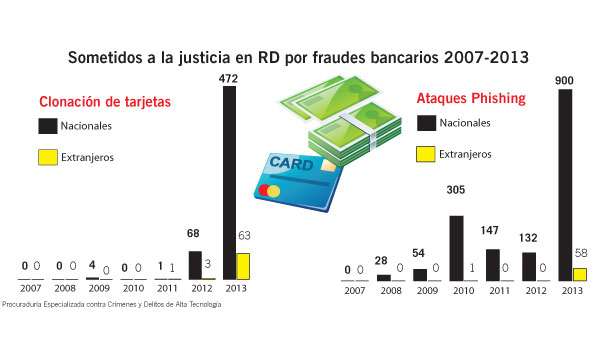

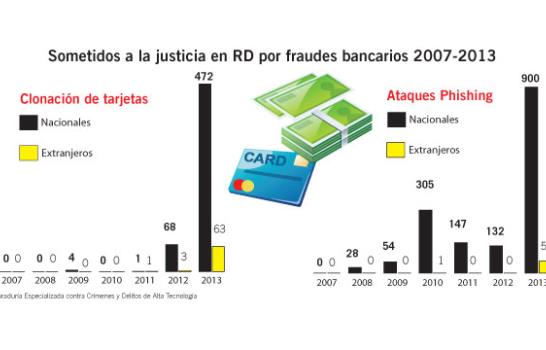

More than 2,000 charged with cloning cards and phishing

SANTO DOMINGO. Over the last six years, 2,234 persons , both nationals and foreigners, have been charged with crimes of cloning cards and stealing information and identities through phishing. Just in the latter activity, used to steal money or information of accounts through e-mail or fake Internet pages, made up 72,7% of the cases.

The head of the Specialized Prosecutor against High Technology Crimes, John Henry Reynoso Ramirez, stresses that before February 2013, the date in which his agency was created, few persons were convicted for the two types of crimes cited above, since 97% of the processes reached some sort of conciliation with the banks or the victims and there was no prosecution focused on cybercrimes.

"With respect to the cloning of credit and debit cards, the normal cardholder usually goes to the banks, and this card has insurance, and as long as they pay his money, the cardholder is not interested in pursuing the case. And the banks themselves are not interested in continuing the prosecution of people. From 2007 until the beginning of 2013 only 69 persons were sent to preventive custody for cloning,"the Prosecutor says regretfully.

In a general way, some 1,850 persons charged for high tech crimes and processed by the Specialized Prosecutor over the last eight months are currently in preventive custody and awaiting their judicial processes which could carry sentences of up to 19 years in prison. Another 28 persons were able to obtain a bail bond.

Foreigners implicated

Foreigners who belonged to networks that worked in cybercrimes between 2007 and 2013, whose activities affected the local banks numbered 67 who were charged with cloning credit cards and 60 who were charged with phishing. "Generally here many Haitians, Canadians, Venezuelans and Colombians are arrested," said Magistrate Reynoso.

There are also criminals of other nationalities. On 27 October 2913, two Bulgarians were arrested in Bavaro accused of placed altered keypads and other apparatus in ATMs in tourist areas in order to get the PIN numbers of the credit or debit cards of the customers in order to clone them, and then make withdrawals. All told, the scam totaled US$200,000.

What sentences would they face?

In less than a year, the new Specialized Prosecutor dealt with 4,115 cases of high tech crimes which included cloning, phishing, nuisance calls and the theft of cell phones.

Of the 1,859 that are in prison for all of these crimes, Magistrate Reynoso expects exemplary punishments. :aw 53-07 on High Tech Crimes establishes that obtaining funds illegally from a card holder's account will be punished with a 10 year prison sentence and a fine of between 100 and 500 minimum salaries.

With respect to the electronic transfer of funds through access codes or any other similar mechanism, the punishment is from one to five years i n prison and a fine of between two and two hundred minimum salaries.

Regarding the fraud carried out through electronic mediums, computers, telematics or telecommunications, these will be punished with a sentences of between three months and seven years in prison and a fine of between 1o and 500 times the minimum wage. Identity theft through the same mechanisms implies sentences of from three months to seven years of prison and between two and two hundred minimum wages in fines.

More capacity to attack

Diario Libre consulted the executive president of the Adopem Savings and Loan Bank, in order to learn her opinion on the work done by the justice system in pursuit of bank fraud. She said that although there have been advance, there is still more work to be done.

Dominican justice on the issue of the prosecution of high tech crimes has been advancing, although there is still a need to strengthen certain aspects that could be easy to implement, especially in the institutions of financial intermediaries (banks), especially at the level of transparency that the national financial sector uses , and the technological platform and the reporting that we send each day to the financial institutions," she says.

In the report "Tendencies in cyber security in Latin America and the Caribbean and government answers", the Organization of American States (OAS) sounds the alert regarding the increase in electronic crimes.

It indicates that in Latin American, two factors commonly block the efforts to deal with the crime: "The lack of resources dedicated to the strengthening of the capacity in cybernetic security and the scarcity of specialized knowledge and practical experience for the implementations of policies or technical abilities."

"Latin America continues to face budgetary restrictions and the spending plans often do not think about big investments in aspects such as computer security. The funds are invested with greater frequency in aspects of "security itself," although this probably will change as the cybernetic crimes continue presenting ever more serious threats against the physical and economic welfare that the stability of governments," says the OAS.

Although they state that there is a lot of work to be done, the OAS concludes that the consciousness regarding cybernetic security is increasing day by day, and the governments are trying to improve their instruments of policy.

Mariela Mejía

Mariela Mejía

Mariela Mejía

Mariela Mejía