AFP earned three times more than affiliates on pension funds

As of September the benefits amounted to RD $2.6 billion

SD. Just imagine that an expert contracted by you tp managed the investment of your savings and for these operations he earned nearly 3 times more than what you received. What would you think? Well if you didn't know it, there it is, because this is exactly what is happening.

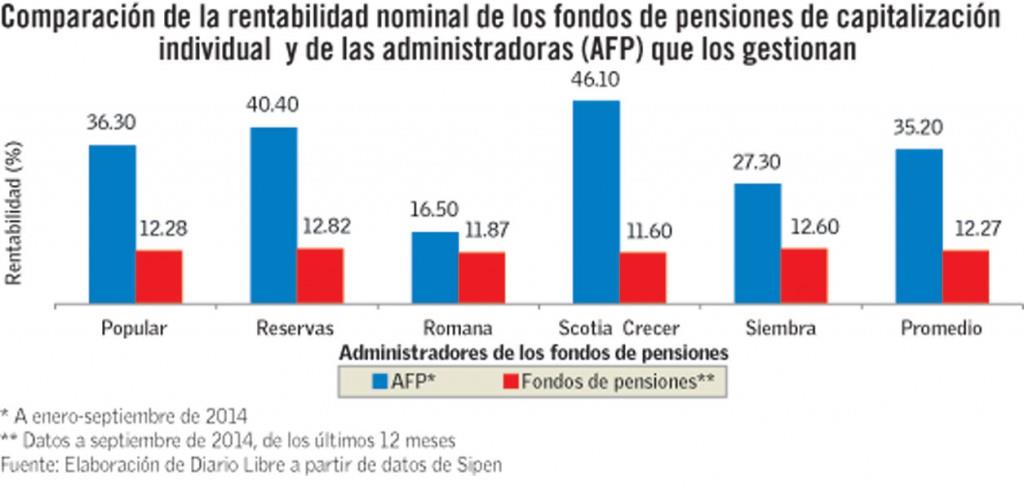

As of September, the pension fund administrators (AFP), which one would suppose are contracted by the affiliates, received a nominal earnings on assets of 35.2%. And you? If you are an affiliate of an individual provisional capitalization pension plan: on average 12.27%.

In its quarterly report, corresponding to the 3rd quarter of the year, the Superintendent of Pensions (SIPEN) reveals that altogether the five AFPs obtained benefits of more than RD $2.6 billion.

As a result of the elevated earnings that the AFPs obtained for the management of those funds, in August 2013, the SIPEN, under the leadership of Joaquin Geronimo, managed to get these administrators to accept a complimentary reduction on earnings, from 30% at that time to 25%.

In addition, in September 2013, the entity submitted a legislative project to the Senate in which the complementary commission was cut back so that it would never be above 15%. This project expired in the Upper Chamber on 26 July 2014, and was later reintroduced, and since 28 August it has been under the study of the Social Security, Labor and Pensions Commission of the Senate.

In addition to the 25% complementary commission for the margin of earnings which is above the earnings of the financial certificates of banks, the AFPs discount from the funds that they administer an additional 0.5% for administration.

Up until now, only the AFP Romana collects a commission of less than 25%. According to the SIPEN report, this fund administrator collects 20%. In the meantime the Banco de Reservas, in spite of being state owned, (which is to say, it belongs to all Dominicans) continues collecting 25%.

A public AFP

The issue of the AFP Reservas takes on relevance in the context of the most recent report from the SIPEN, in which it mentions the social importance of a "public AFP". In this report, they mention the case of Chile, where was it suggested that a Public AFP be created, under the argument that in that country, since 2010 the private fund administrators "had not reduced their commissions."

In the Dominican Republic, ever since the creation of the system in September 2003 and up until September 2013 they have never reduced the commission: including the AFP Reservas.

According to the SIPEN, in the Dominican pension system there exists "a complex procedure of transfer," from one AFP to another. The difficulties that an affiliate has to face in order to change from his AFP are only comparable to that of Bulgaria, they say. In both countries this right of the affiliates is very difficult to execute. In 2012 only 0.3% of the Dominican affiliates could carry it out, while in Costa Rica it was carried out by 9%.

The inability of the affiliate to move his/her account, is seen in the fact that they are only allowed to leave the system in the cases in which "they will not reach a sufficient amount in their accounts to receive the amount of a pension, at the end of their work life." Some 48,490 affiliates have already left the system, which on the average have received each one RD $76,534.58 as their lifetime savings.

Only 48.13% contribute

As of September 2014, the assets of the funds amounted to RD $291.4 billion, of which 78.1% corresponded to the individual retirement funds (CCI). Other plans such as that of sharing, complementary, social solidarity and that of the teachers, represent the remaining 21.9%. The system has a little more than 3 million affiliates. Nevertheless, as of last September, only 48.13% contribute. This percentage goes down as a result of instability in the labor force.

As of September, the pension fund administrators (AFP), which one would suppose are contracted by the affiliates, received a nominal earnings on assets of 35.2%. And you? If you are an affiliate of an individual provisional capitalization pension plan: on average 12.27%.

In its quarterly report, corresponding to the 3rd quarter of the year, the Superintendent of Pensions (SIPEN) reveals that altogether the five AFPs obtained benefits of more than RD $2.6 billion.

As a result of the elevated earnings that the AFPs obtained for the management of those funds, in August 2013, the SIPEN, under the leadership of Joaquin Geronimo, managed to get these administrators to accept a complimentary reduction on earnings, from 30% at that time to 25%.

In addition, in September 2013, the entity submitted a legislative project to the Senate in which the complementary commission was cut back so that it would never be above 15%. This project expired in the Upper Chamber on 26 July 2014, and was later reintroduced, and since 28 August it has been under the study of the Social Security, Labor and Pensions Commission of the Senate.

In addition to the 25% complementary commission for the margin of earnings which is above the earnings of the financial certificates of banks, the AFPs discount from the funds that they administer an additional 0.5% for administration.

Up until now, only the AFP Romana collects a commission of less than 25%. According to the SIPEN report, this fund administrator collects 20%. In the meantime the Banco de Reservas, in spite of being state owned, (which is to say, it belongs to all Dominicans) continues collecting 25%.

A public AFP

The issue of the AFP Reservas takes on relevance in the context of the most recent report from the SIPEN, in which it mentions the social importance of a "public AFP". In this report, they mention the case of Chile, where was it suggested that a Public AFP be created, under the argument that in that country, since 2010 the private fund administrators "had not reduced their commissions."

In the Dominican Republic, ever since the creation of the system in September 2003 and up until September 2013 they have never reduced the commission: including the AFP Reservas.

According to the SIPEN, in the Dominican pension system there exists "a complex procedure of transfer," from one AFP to another. The difficulties that an affiliate has to face in order to change from his AFP are only comparable to that of Bulgaria, they say. In both countries this right of the affiliates is very difficult to execute. In 2012 only 0.3% of the Dominican affiliates could carry it out, while in Costa Rica it was carried out by 9%.

The inability of the affiliate to move his/her account, is seen in the fact that they are only allowed to leave the system in the cases in which "they will not reach a sufficient amount in their accounts to receive the amount of a pension, at the end of their work life." Some 48,490 affiliates have already left the system, which on the average have received each one RD $76,534.58 as their lifetime savings.

Only 48.13% contribute

As of September 2014, the assets of the funds amounted to RD $291.4 billion, of which 78.1% corresponded to the individual retirement funds (CCI). Other plans such as that of sharing, complementary, social solidarity and that of the teachers, represent the remaining 21.9%. The system has a little more than 3 million affiliates. Nevertheless, as of last September, only 48.13% contribute. This percentage goes down as a result of instability in the labor force.

Edwin Ruiz

Edwin Ruiz

Edwin Ruiz

Edwin Ruiz